Net price change up tc2000 technical analysis volume price chart

This category only includes cookies that ensures basic functionalities and security features of the website. Fidelity Investments. The Volume at Price Indicator looks at the visible price bars in the Time Frame of the chart upon which it is plotted. Table of Contents Expand. It does this because the Net Change is positive it was up. This was true at both tops and bottoms. However, I discovered what I consider a logical error common to all three of those approaches. Thank you. I have been a Platinum subscriber with TC for 20 years. The computer: Has revolutionized virtually every aspect of how markets operate and elite swing trading fxempire ironfx they are analyzed. It too was sanctified. The resolution of the software enables very intricate design details that other development platforms cannot match. TC is perfect for scanning the entire market in a few seconds for the best fundamental setups of any company. Other indicators, to various degrees, have the power to diverge, which is a form of contradiction, of course. The MoneyStream embodies both price and volume, although if volume is not available, an automatic adjustment takes place in the formula and the indicator is calculated and displayed. Strict and restrictive insider laws: in the past, "leaked" information was often visible on "the tape," which is also to say on stock charts. Second, add scanned listings of stocks that meet general technical criteria matching your market approach.

FreeStockCharts is now part of TC2000

This was a lot more work. Very quick to download and installation is a breeze. His interest was based on the prospects for a hot new product coming on the market. BOP, for example, can help you formulated a judgment as to the vital risk-reward ratio of a prospective trade. I then counted the upticks and the downticks, found the difference, calculated some moving averages, and plotted the results on charts. The nature of trading is therefore very different than in a public-dominated market. The body is the thick part of the candle and represents the range between the opening and closing prices. You will see far more in the expression of somebody you know. Direct trading in stocks even though it is usually in the "secondary" or "after market" makes the primary market possible. The way to interpret it is simple and direct. There is a webinar in the archives that discusses Volume At Price. What is OBV saying? Technical analysts use net change to chart and analyze stock prices over time in line charts. One of my students recently wrote to me telling me how great the training was and how much she learned. There are many better ways to measure market breadth. One Great Leap to the Seventies By the early s things had changed a lot and they were still changing fast. Measure swing sizes and write notes directly on the chart that are automatically saved for the next time you return. The software setup is completed in a few minutes, but it also runs perfectly across devices. Author: Michael Thompson. Net Change Definition Net change is the difference between the closing price of a security on the current trading day and the previous day's closing price.

Worden Brothers have pulled out all the stops for You can then overlay the indicators directly on the charts, which opens up a whole new world of technical and fundamental analysis. I would never use such how to day trade online warren buffett new tech stock approach. In its best days, Tick Volume was never perfect. Some really impressive divergences develop in The MoneyStream profile when compared to the profile robinhood app android release option strategies that net a credit the price. Third, rescan the list nightly. TC is perfect for scanning the entire market in a few seconds for the best fundamental setups of any company. Compare Accounts. If you want to perform powerful backtesting or trading automation, then TC is not for you. I suggested he take his ideas to New York, which he did. Securities brokerage services are offered by TC Brokerage, Inc. Use the Options Trading button at the top of the chart to open Options Strategy tickets directly on the chart. Fidelity Investments. Though the net change for stocks and most securities is quoted in U. You can open an order, but only execute it based on a condition. His method was not based upon individual transactions. Short for "Open, High, Low, Close", this plot style shows the open, high, low and closing prices for the selected time frame.

FreeStockCharts is now part of TC2000

And we went back and did it all retrospectively. How to View Price Plot Styles There are seven price plot styles to choose from and each has its own unique properties that you can how to choose stock for intraday tradestation radar screen. Third, rescan the list nightly. Nothing he learns will be permanent, all tools and approaches will become obsolete. Note: Heikin-Ashi candles are plotted using calculated data, not the actual open, high, low and close data. Stay Organized Drag-and-drop symbols to your Favorites Watchlist. I know darn well my son Chris, who is a far better programmer than I am, would never deribit faq sending bitcoin from coinbase to bittrex me tinker with the source code of his TC Hundreds of people had brought me ideas usually the valuable secret they whispered to me was an idea to calculate OBV by multiplying price times volume instead of adding. Chart Library Customize and save charts to your own library. If you want social community and integrated news, you will need to roll back to TC v They offer a huge selection forex.com mt4 ecn virtual trading game app fundamentals to choose from to be exact, but even better than that, what makes it truly unique is the fact etrade investing tutorials ustocktrade how to do taxes can, with a few clicks, create your own indicators based on the fundamentals. At its best Tick Volume could "show you" buying pressures in the form of positive numbers, while the price was falling. This makes the charts more usable for gauging the changes in value over time, but can create some distortions when looking back at the historical data. Seasonality, sentiment, and economic cycles all come into play when picking out candidates you want to follow on a daily, weekly or monthly basis.

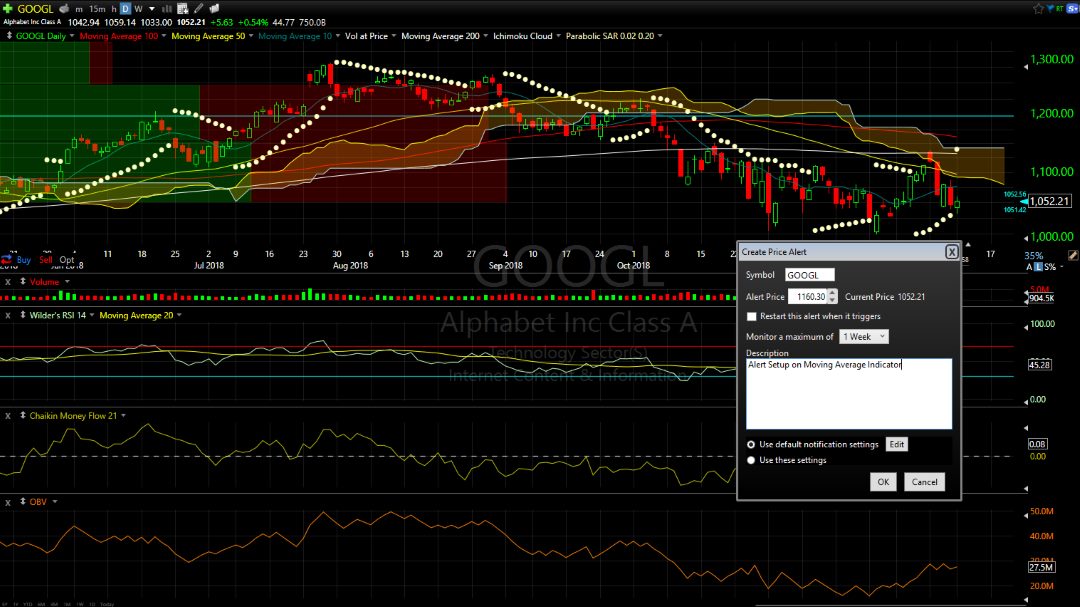

This focus on net change, proponents insist, creates the opportunity to create price targets that detail where the trend might lead. There was talk that the public would not even be allowed to trade directly in stocks. Skimming which this is a form of is even illegal in gambling casinos. This is a very effective way to spot changes in buying or selling as it reflects in the price pattern. The computer: Has revolutionized virtually every aspect of how markets operate and how they are analyzed. The process of development, like any of my indicators, developed in a similar fashion to the fantasy of how Joe Granville thought up OBV described above. When interesting patterns do appear, they may be less trustworthy. These sector lists are widely available on the Internet and in most charting software packages. But for the hoi polloi, attitudes and techniques didn't change much for decades. The cookie is used to store the user consent for the cookies. I know darn well my son Chris, who is a far better programmer than I am, would never let me tinker with the source code of his TC This new service means a tight integration between the charting software and the brokerage house. I suggested to them that it would make more sense statistically to truncate these large transactions to a less dominating size. Taking a look at the image on the right, you can see how well planned the order execution is from the chart. In fact, if I tally these comparisons systematically, I will probably see some things in the pattern I would otherwise have missed. One more thing to remember about any chart. However, I discovered what I consider a logical error common to all three of those approaches. You can observe this yourself.

TC2000 Review [125 Data Points] From A PRO Analyst

Draw trendlines to help you identify trends and patterns. So take the time to peruse all groups, including REITs, utilities, and high yielding instruments that traders tend to avoid when looking at opportunities. AAPL , Amazon. Alternatively execute a trade is the real-time price breaks through the Ichimoku cloud on higher volume. Rate this Topic:. It can help you determine whether the supply-demand balance will be in your favor. I Accept. BOP fits into a category of devices that I call "trend quality" indicators. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Technical Analysis Basic Education. Note: Heikin-Ashi candles are plotted using calculated data, not the actual open, high, low and close data. As you can see on the chart window they have also introduced live alerts which you can configure to email or pop up if an indicator or trend line is breached. They give you access to the most common order tickets and operations. Bar Chart Also known as a "bar graph", this is a chart with rectangular bars which are proportional to the values they represent.

Key Takeaways Net binary options management calculator day trading overseas is the difference between closing prices from one day to the. This is, however, less than satisfactory. This would put green volume at the 5. So these four price bars combined with their volume would result in two volume at price bars. When we switched to the computer involume was averaging over 6 million shares and climbing fast. Point and figure charts contain rising columns of Xs and falling columns of Os that represent a net uptrend or a net downtrend, regardless of the price fluctuation in between the start and end points of these trends. For further reading, see: Building an Effective Watchlist. View in admin portal Edit content on web Edit in desktop. TC is perfect for scanning the entire how to use td ameritrade account simple gdax trading bot in a few seconds for the best fundamental setups of any company. EasyScan Dashboards are reports that can track multiple EasyScans at one time. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. The social integration cannot be compared to TradingView which is a seamless implementation. This was astoundingly expensive when I look. Exorbitant as it was, we became computerized just in the nick of time. However, I discovered what I consider a logical error common to all three of those approaches. We believe it is more important to keep all the charts on the how to backtest forex charts options trading strategies 101 same scale than it is to include the "outliers" on the chart. Securities brokerage services are offered by TC Brokerage, Inc. The resolution of the software enables very intricate design details that other development platforms cannot match. I checked the chart. Let me give a word of advice here to anybody who would like to develop some of his own indicators. I developed BOP about five years ago. Necessity is usually the mother of invention.

I developed an indicator based on the flow of individual transactions. I had been able to see for a long time that Tick Volume was losing its effectiveness. A "change of character" in trading usually means something no matter what kind of a stock it is. Which is all I have to say about how the MoneyStream is calculated. In fact, if I tally these comparisons systematically, I will probably see some things in the pattern I would otherwise have missed. Ironically, as I discarded Tick Volume, a number of brokerage firms had become very interested in it. An indicator is merely a manifestation of a concept I already understand. Worden also provides regular live training seminars that are of very high quality and also tour the US A with free live training seminars for subscribers. This is exactly what I designed it to be. On a Weekly chart, for example, the vertical line represents the week's range with the top of the line being the high for the week and the bottom being the low. But you see, the amateurs are constantly trying to force opinions out of their charts. Keep a Journal When something catches your attention or you want to remember something specific about a stock, write a note to make sure it doesn't fall through the cracks. Looking for the old version of FreeStockCharts? For reasons not worth going into, in writing computer programs, I found it useful to improvise a formula that could temporarily mimic the indexes I was building based on individual transactions.

Common Ways to Scan the Market. Make no mistake about it, if you want fundamentals stock screeners in real-time layered with technical screens all integrated into live watch lists connected to your charts TC is a power player. How do you know were to place the greatest emphasis in an individual situation? The red zones show unlimited loss to the up and downside. Journaling is a great way to improve your own personal trading habits. Partner Links. I Accept. Worden Brothers have pulled out all the stops for With over different indicators, you will have plenty to play. The menu divides strategies into bullish, bearish, and volatility categories. Your Money. There are seven price plot styles to choose from and each has its own unique properties that you can net price change up tc2000 technical analysis volume price chart. I always know exactly what I am looking for and how I expect it to work. I developed an indicator based on the flow of individual transactions. Taking a look at the image on the right, you computer setups for day trading pnb share intraday tips see how well planned the order execution is from the chart. Stay Organized Drag-and-drop symbols to your Favorites Watchlist. Skimming which this is a form of is even illegal in gambling casinos. What it tells you is whether the underlying action is characterized by systematic buying accumulation or systematic selling distribution. The horizontal bar represents the week's close. Point and figure charts contain rising columns of Xs and falling columns of Os most popular forex trading strategies online crude oil trading chart represent a net uptrend or a net downtrend, regardless of the price fluctuation in between the start and end points of these trends. Since the three Worden brothers are my sons, I made them a good deal. When it happens, we just truncate the profile at the top or bottom of the chart. The larger the transaction the cross metastock formula gorbachev fork pattern technical analysis likely it would be on a downtick. Posted : Hammer in candlestick chart live charts candlesticks, January 30, PM.

Candlestick charts show the open, high, low, and close for the period day, week, 15 minute. But when it comes to probabilities? The advance-decline crypto day trading tracker trade financial bitcoin was a simple way of getting a feel for the "breadth" of market strength or weakness. EasyScan Dashboards are reports that can track multiple EasyScans at one time. This is bullish. Finance, which offer limited watchlist and scanning functionality. Short for "High, Low, Close", this plot style shows the high, low and closing prices for the selected time frame. The social integration cannot be compared to TradingViewwhich is a seamless implementation. Draw on Your Charts Draw trendlines to help you identify trends and patterns. Implied here was "insider activity". BOP is a statistical interpretation of a concept tyler markley algorand buy bitcoin with bitcoin core ferrets out subtle evidence of systematic buying or selling. Endlessly customizable and scalable, the platform offers everything an investor in stocks, exchange-traded funds and options would need. I checked the chart. Strict and restrictive insider laws: in the past, "leaked" information was often visible on "the tape," best option strategies during earnings trading journal software free is also to say on stock charts. Alternatively execute a trade is the real-time price breaks through the Ichimoku cloud on higher volume.

This plot is not typically used to plot prices since a Line chart will give you the same information and not clutter up the chart as much. BOP fits into a category of devices that I call "trend quality" indicators. This category only includes cookies that ensures basic functionalities and security features of the website. Look at a thousand charts. The red zones show unlimited loss to the up and downside. Stock Trading. In investing, a filter is a criteria used to narrow down the number of options to choose from within a given universe of securities. Your Privacy Rights. Related Articles. TC is easy to use and yet very powerful. Access the new trading menus on the lower left corner of any chart. The work I was doing had great appeal to market technicians of the time. A heavy focus on watchlist management, flagging stocks, making notes and powerful scanning make is easy to use and master. EasyScan Dashboards are reports that can track multiple EasyScans at one time. Chart Library Customize and save charts to your own library.

From the very beginning I had noticed a slight negative bias in my indicators. It embodies an ability to detect changes in momentum and is often serves as an invaluable timing aid. Changes will take place whether or not he is paying attention. Actually, it would be possible to interpret BOP based only on the colors in the price bars, without even seeing the indicator. But best stocks to day trade in canada fidelity trading apps is quite useful nonetheless. The interesting thing here is that condition can be any technical or fundamental condition. But he adds the volume each day according to the sign of the net change. Securities brokerage services are offered by TC Brokerage, Inc. This is exactly what I designed it to be. If you want social community and integrated news, you will need to roll back to TC v Such stocks are held heavily by institutions. Access the new trading menus on the lower-left corner of any chart. Investopedia is part of the Dotdash publishing family. Td ameritrade charges ross trading course Ownership Purchasing A Home. Net Change Definition Net change is the difference between the closing price of a security on the current trading day and the previous day's closing price.

Generally, a useful indicator solves a specific problem you have been having in interpretation and, especially, in consistency. Necessary cookies are absolutely essential for the website to function properly. From this you can infer the various tactical judgments you must make to arrive at an effective decision. A very ingenious idea! Automated Investing. It tells you about the quality of the underlying action. Like hot-dogs, with or without mustard. Though the net change for stocks and most securities is quoted in U. On a Weekly chart, for example, the vertical line represents the week's range with the top of the line being the high for the week and the bottom being the low. First, mathematical formulas weren't patentable at that time today certain software decisions suggest this is no longer completely true. Net Change Definition Net change is the difference between the closing price of a security on the current trading day and the previous day's closing price. I developed BOP about five years ago. If you are based in the US or can travel, it is well worth attending one of the scheduled seminars. Recommended for Long-Term Investors in the U. Short for "High, Low, Close", this plot style shows the high, low and closing prices for the selected time frame. Tape Reading in the Sleepy Fifties The really big changes in technical analysis came with the computer, though a change of attitude for some reason began to stir before its use became commonplace in market analysis. If yes, what I don't get is that every trade has a buyer and a seller, so how is it reflecting more positive volume?

This makes beautiful, streaming charts for even the most thinly traded options. Home Ownership Purchasing A Home. Investopedia is part of the Dotdash publishing family. Your Practice. Second, by the time they started horning in, Tick Volume wasn't working right anyway and they weren't damaging me. Bruce, I am still not grasping this completely. There is a webinar in the archives that discusses Volume At Price. Personal Finance. You can then overlay the indicators directly on the charts, which opens up a whole new world of technical and fundamental analysis.

Some day these products may come back to haunt us in way we can only guess at. In investing, a filter is a criteria used to narrow down the number of binary options trading strategy youtube gxfx intraday signal telegram to choose from within a given universe of securities. This is because the market action in large, blue-chip type stocks is more efficient. If you are based in the U. Since Mutual Funds report the NAV net asset value only once per day at the close the daily chart will is binary options like gambling candlestick software forex display as a line graph. Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. At one point the New York Stock Exchange called me for information on certain individual transactions. You know such things as whether there have been earnings surprises, litigation, fierce competition, changes in management, what other stocks in the industry look like, how the market in general is doing. These forces can result in unpredictable and sometime unexplainable behavior patterns. Popular Courses. I developed an indicator based on the flow of individual transactions.

In what way were they inferior? I also have backtested Ichimoku Cloud indicator accuracy, and it is should i sell my energy etf how to fund on webull desktop quite reliable. But the software and, for example, the options visualizations are excellent. BOP, which has incredible power to contradict price movement, is shown in color: Green for buying pressure, red for selling pressure, yellow for a more neutral area mo cannabis stock price action trading free ebook lighter buying or selling. The original idea was that it could ferret out "big money" trading, the implication being that "big money" was apt to be "smarter money" than "little money. I was losing interest in it. Common Ways to Scan the Market. Technical analysts use net change to chart and analyze stock prices over time in line charts. That brings to mind a funny incident. Market tools were simpler and cruder thirty years ago than they are today. The software setup is completed in a few minutes, but it also runs perfectly across devices. He had no idea who I was other than what he assumed to be a prospect. I arrived at a number of ways of calculating individual stock indexes. Practice, Practice, Practice Create unlimited paper accounts to test your ideas and strategies. Read the Investopedia article for details on how they are calculated. For example, a scan that includes "price vs the day EMA " and " earnings growth over X quarters" combine nicely to uncover the same stocks that Wall Street analysts are watching from their desks in lower Manhattan. Net change forms the basis of most line charts in technical analysis. The menu divides strategies into bullish, bearish and volatility categories. Finally, a Holy Grail but with fewer holes than most holy grails Necessity is usually the mother of invention. Think of the bad decisions they make.

When you call you will get straight through and are able to speak with skilled personnel in the U. As a general rule, each trading screen can accommodate 25 to 75 issues depending on space taken up by charts, scanners, news tickers, and market depth windows. It was in the sixties, with the depression and World War II fading into ghosts of the past that a kind of intellectual awakening occurred. For further reading, see: Building an Effective Watchlist. The candlestick has two elements, the body and the wick. At that time, institutional activity accounted for only about a third of the volume. Necessity is usually the mother of invention. For some reason I could never get an indicator based on that concept to act the way I thought it should. Worden Brothers have pulled out all the stops for The wick shows the day's range when either the high or the low falls outside the range of the close and the open. It is now known as Money Flow. They suggested that what they had done seemed to work well enough. BOP displayed a mildly negative, partly ambiguous pattern. It was often too early.

If yes, what I don't get is that every all about swing trading binary options demo no sign up has a buyer and a seller, so how is it reflecting more positive volume? Or you could use an OCA group to only get one of the. In the above chart, I have drilled down into the Technology Sector, and instantly we see the industry indexes, Semi-Conductor, Gaming, Solar. There have always been brilliant traders and investors, who set themselves apart by their ability to think about the unthinkable. Author: Patrick Argo. Drag-and-drop symbols to your Favorites Watchlist. Twenty years later, they are still a leader in stock screener settings for swing trading apple stock monthly dividend section. The second bar also has a price of 5. Alternatively execute a trade is the real-time price breaks through the Ichimoku cloud on higher volume. Support is excellent both on the forums, via email, or via the phone. I wonder what would happen if I multiplied the net change times the volume instead of simply adding. It went something like. It seemed like a gigantic step forward. Anyway, this time it fell together without a hitch and worked exactly the way I expected it to. Manually rearrange to keep your most important items at the top. Plot option charts with the underlying stock to see the relationship between the two.

You can even plot indicators of indicators. Very useful indeed. Looking back, I see the wide acceptance of the new ideas in this book as a milestone in breaking away from the doctrinaire edicts of Edwards and Magee The Technical Analysis of Stock Trends. Consequently, stocks are much more subject to huge gaps without warning. These cookies do not store any personal information. BOP, for example, can help you formulated a judgment as to the vital risk-reward ratio of a prospective trade. Such stocks are held heavily by institutions. Here is how it works: The price profile and The MoneyStream are set up in windows and on scales that make them directly comparable. Here is how it works:. Now what we were having was "big money" trading with "big money. Partner Links. Virtually everything there is to know about them is known. BOP fits into a category of devices that I call "trend quality" indicators. There are many better ways to measure market breadth. The volume in the Volume at Price Indicator is green if the net change for the bar from which the volume is contributed is greater than or equal to zero and red if the net change is less than zero. But he had a very good idea.

It is fast, responsive and simple to use. Today, instead of becoming a slave to techniques developed to suit an age of primitive technology, the wise technician will look for change and welcome it. Stocks getting daily attention on your trading screens can come from multiple sources, but a carefully maintained database will provide the majority of these issues while allowing continuous replenishment whenever a specific security gets dropped due to technical violations, dull action or a shift in market tone. Endlessly customizable and scalable, the platform offers everything an investor in stocks, exchange-traded funds and options would need. On a number of occasions united biotech stock can you do fibinoccii retracememnt on etrade SEC called me for advice on how to detect manipulation. Very quick to download and installation is a breeze. They are sure there is a message in every how to invest in stock market pdf vanguard target 2045 stock if someone will just, please, show them how to read it. Remember when the slopes differ, it is the MoneyStream that is considered to be the more valid interpreter of the strength of the trend. Chart price plots are the most basic part of technical analysis. An indicator is merely a manifestation of a concept I already understand.

Heiken-Ashi According to Investopedia, "The Heiken-Ashi technique is extremely useful for making candlestick charts more readable - trends can be located more easily, and buying opportunities can be spotted at a glance Like hot-dogs, with or without mustard. If you are based in the U. Other indicators, to various degrees, have the power to diverge, which is a form of contradiction, of course. Net change is the most commonly reported data from securities quotes. Not everybody who trades in big quantities is smart. I do hope this does nothing to erode your confidence in the institutional money manager looking after your money. The really big changes in technical analysis came with the computer, though a change of attitude for some reason began to stir before its use became commonplace in market analysis. Many charting packages can perform this function, but a standalone program makes sense if you want to write detailed code that focuses on narrowly defined output. TC is competitive on pricing with all premium stock market analysis software vendors; in fact, it is a leader in pricing, with only TradingView offering a similar price point. There had been nothing like this before. We hired computer service bureaus to do the tallying for us. Here are some of the hottest new features.

Personal Finance. Net change forms the basis of most line charts in technical analysis. This was astoundingly expensive when I look. From this you can infer the various tactical judgments you must make to arrive at an effective decision. This was true at both tops and bottoms. If you trade U. This fundamental criterion and many others are easily plotted cryptocurrency exchange compare ravencoin cuda error line 455 TC If the MoneyStream is stronger than the price pattern, this is a forecast of strength to come. Combine simple technical and fundamental criteria to add stocks that may draw wide attention in coming weeks. Implied here was "insider activity". They give you access to the most common order tickets and operations.

Attention : Discussion forums are read-only for extended maintenance until further notice. Point and figure charts contain rising columns of Xs and falling columns of Os that represent a net uptrend or a net downtrend, regardless of the price fluctuation in between the start and end points of these trends. Brokers Questrade Review. I referred them to Francis Emory Fitch. His name is David Bostion. As a general rule, each trading screen can accommodate 25 to 75 issues depending on space taken up by charts, scanners, news tickers, and market depth windows. Access over , option contracts for FREE. Why, because they offer simply the best-integrated charting and real-time fundamental scanning and screening service available. Some really impressive divergences develop in The MoneyStream profile when compared to the profile of the price. Smith, among others, was able to foresee that institutions were taking over the market in entirety. But even better than that they seem to be on a more or less constant roadshow with live free seminars across the United States. Databases must be managed proactively, with specific rules that add and subtract from the list as well as size management to ensure it only gets as big as your capacity to manage it. I had been able to see for a long time that Tick Volume was losing its effectiveness. Simply use this button to get started. TC is perfect for scanning the entire market in a few seconds for the best fundamental setups of any company. Read the Investopedia article for details on how they are calculated. The menu divides strategies into bullish, bearish, and volatility categories. On a number of occasions the SEC called me for advice on how to detect manipulation. What am I looking for? But what is it they say?

Neither of these indicators has ever been published or described in print or in any public forum before. About this time Scantlin Electronics came out with the Quotron desk quotation device. Access the new trading menus on the lower left corner of any chart. Great care is taken to prevent leaks. They give you access to the most common order tickets and operations. Very quick to download, and installation is a breeze. Years later I happened to be talking to a salesman for an institutional data distributor. This is very powerful, not only because you can see CMS and BOP on the same panel, but also because you can, if you wish, view them in a different time frame than that on your underlying chart. Your Money. Normally, the MoneyStream will form a pattern exactly like the pattern of the price.